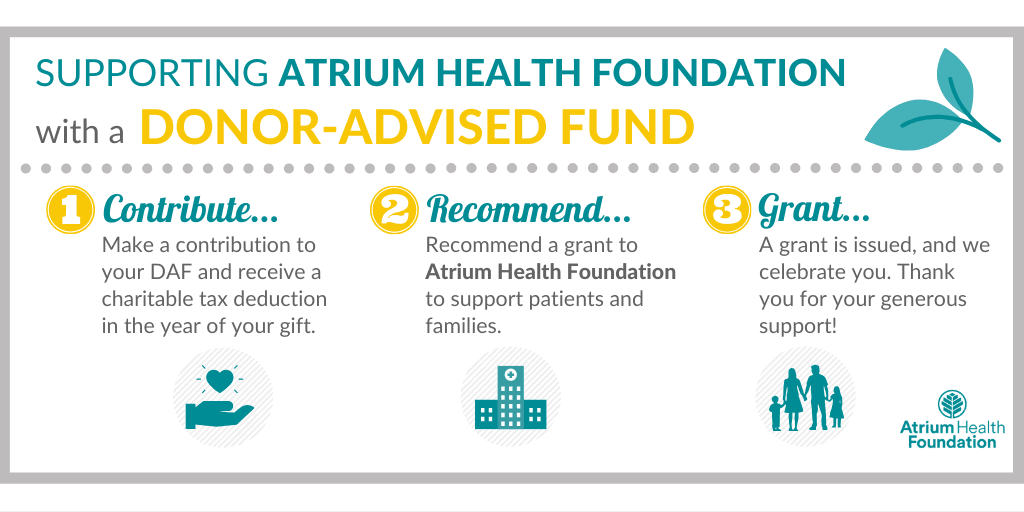

A donor-advised fund is a convenient way to support Atrium Health.

A donor-advised fund (DAF) is like a personal charitable checking account, for the sole purpose of supporting charitable organizations you care about, like Atrium Health.

When you contribute cash, securities or other assets to a donor-advised fund at a public charity, like Fidelity Charitable, Schwab Charitable, Vanguard Charitable, or your local community foundation you are generally eligible to take an immediate tax deduction.

Donor-advised funds are tax-efficient and convenient charitable tools. You contribute to your DAF on your own schedule and recommend grants to as many IRS-qualified public charities in the United States, as you choose, in your own time.

Benefits of a donor advised fund:

- Easy to establish a flexible vehicle for annual charitable giving

- Easy to use – online access for grant recommendations

- Obtain a charitable income tax deduction in the year of your gift

- The DAF advisor receives recognition, just like a direct gift

To learn more about making a gift to Atrium Health Foundation using a donor-advised fund, please contact Beth Braxton, Director of Gift Planning, Elizabeth.Braxton@atriumhealth.org.

Introducing: DAF Direct

DAF Direct’s mission is to support nonprofits by providing a cost-efficient and simple way for donors to give, and nonprofits to receive grants. DAF Direct welcomes donors to recommend grants from their donor–advised fund, also known as a DAF, directly from our website using the widget found below. Neither you (the donor) nor Atrium Health Foundation will incur any download or transaction fees.